Sooner or later, you’ll benefit from having healthy credit, such as if you want to get a home loan or credit card. But it’s not always easy to build credit, which is why companies like Self are so valuable.

What is Self? Self is a fintech company that helps people build credit, with special emphasis on people who are new to credit or don’t have access to traditional financial products. There are other companies as well that are stellar when it comes to credit building.

Read on to gain an in-depth analysis of what Self is all about and how it can benefit you. We’ll start by looking at how this company came about.

What's Ahead...

Brief History Of Self

Self is based in Texas and was founded in 2014. It has partnered with Sunrise Banks, N.A., a bank based in Minnesota that was established in 1962, as well as Missouri-based bank Lead Bank, which has been around for more than 80 years.

Self has achieved an “A” rating by the Better Business Bureau and has been accredited since 2016.

How Self Works

Self offers credit-builder loans that allow you the chance to build credit or restore bad credit.

Basically, you’ll be establishing a loan to which you pay money and then receive the money in full once your payments have all been made.

This is an important point: the money you borrow won’t be received by you immediately but your payments will be preserved in a certificate of deposit (CD).

This is insured by the Federal Deposit Insurance Corp. When you’ve made all the payments you need to make on the loan, the money will be released so you can use it.

The CD comes with a term of 12 or 24 months and will be held in your name.

How the process works

1. First things first, you have to meet certain criteria to apply for a loan. These include the following:

- You must be at least 18 years old.

- You must be a permanent U.S. resident.

- You must have a Social Security number.

- You must have a bank account or debit card.

2. Once you apply for the loan, you will have to wait for your loan application to be approved by Self. When this occurs, the amount for the loan will be deposited in the certificate of deposit (CD) with one of the company’s partner banks.

3. The company allows you to make use of either one-year or two-year terms for the loan. You can choose the one that best suits the monthly payment you’re able to make. The lowest payment is $25 per month. You’ll have to make regular payments until the loan is paid off.

4. Self will report your payments to the major credit bureaus. Here’s where building good credit comes into the picture. It’s essential to make payments on time as late ones will harm the credit you’re trying to establish.

5. After six months, your repayment habits will produce a FICO score if you didn’t already have one.

Self Pros And Cons

Pros

- Once the payments are completed, you will be able to receive your funds within 10 to 14 business days after you’ve requested them.

- You don’t need to meet any income requirements to open this account.

- You can still open an account even if you’ve got no or bad credit.

Cons

- You can’t temporarily suspend or deactivate your account.

- You can’t withdraw the money until your loan has been paid in full according to the terms of your plan.

What If You Want A Secured Credit Card Instead?

Some people prefer making use of a secured credit card instead of a loan. This is because of how you can use your credit limit at any time. The risk, of course, is that you could end up harming your credit rating by doing this.

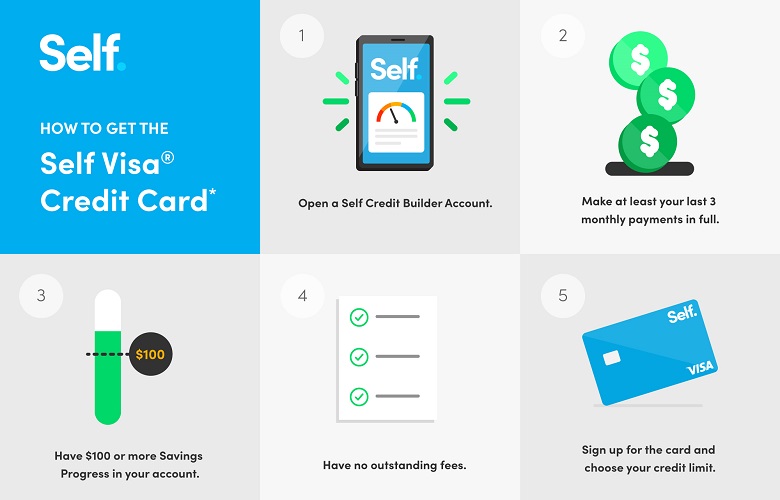

Self does offer a Visa credit card that’s secured by the money you’ve paid on your Self loan. It doesn’t require a credit check, so it’s great if you have bad credit. This card works in a similar way to the loan in that the secured card reports your payments to the major credit bureaus.

Using this card with your loan can help you to build good credit at a faster rate because it shows credit lenders that you can juggle different credit types in a responsible manner.

It’s important to note that you will have to ensure you qualify for the Self credit card. You need to have made a minimum of $100 worth of payments on the loan, your account must be in a healthy standing, and your last three payments must have been made on time.

What Are Self’s Penalties Like?

If you don’t make payments on the loan on time, you can risk getting a bad credit rating. If your payment is 15 days later or more, you’ll receive a fee of five percent of the scheduled monthly payment. If your payment is 30 or more days past its due date, it will be reported to the credit bureaus.

Related Questions

What credit bureaus does Self send information to?

The credit builder account will report information to all three credit bureaus: Experian, Equifax, and Transunion.

Is Self’s customer service good?

There are mixed reviews about the company’s customer service. However, the company does make it easy for customers to get in touch.

You can call them on the phone, email them, chat via the website, or use the Self app (available on Apple and Google Play) to get in touch.

Conclusion

If you want to start building good credit, you should look into opening a credit builder loan with Self. Remember, part of the credit building process is choosing a bank to re-build your credit with AND using tools like these to build credit on a daily and monthly basis.

In this article, we’ve looked at what you stand to gain by doing so and have also provided you with information about the company’s secured Visa card which can further help you to enjoy better credit.

Sources:

Is Self a Legit Company?

Paul Martinez is the founder of BendingDestiny.com. He is an expert in the areas of finance, real estate, and eCommerce.

Join him on BendingDestiny.com to learn how to improve your financial life and excel in these areas. Before starting this blog, Paul built from scratch and managed two multi-million dollar companies. One in the real estate sector and one in the eCommerce sector.