If you’re curious about your credit rating – and you should be – learning what it is can help you find ways to improve it so you can make use of various benefits, such as loan approvals. There are many solid credit reporting services and Experian is one of them.

Experian is a credit-reporting company, otherwise known as a credit bureau. How it works is that it gathers and studies people’s credit information to rate their ability to pay back a debt.

How does Experian calculate credit ratings? The company makes use of Fair Isaacs Company (FICO), as it uses algorithms to provide credit scores of between 300 and 850.

Various factors will affect your credit score, such as the amount of debt you have, the types of accounts you hold, and more. But Experian also offers a service known as Experian Boost that makes it easier to get good credit.

Let’s see how it works and if it’s worth it.

What's Ahead...

What Is Experian Boost?

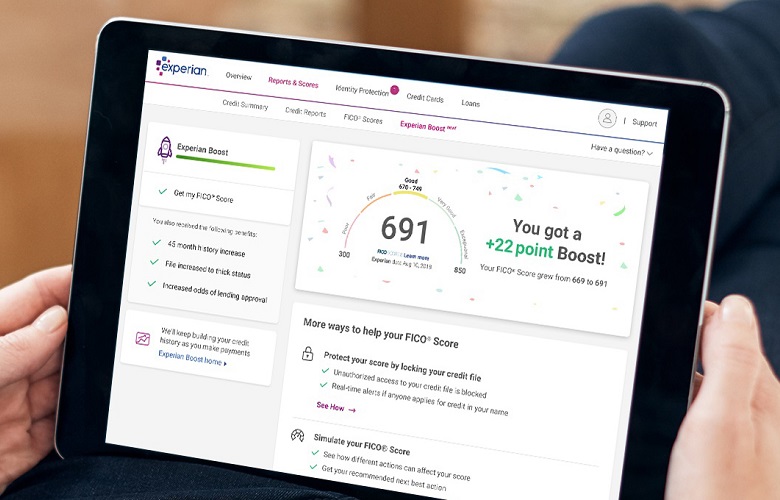

You know that building good credit can take time, but Experian Boost allows you to instantly increase your FICO score because you can use information from your bill and streaming service payments to improve your credit rating.

You just have to connect the account that you use for paying your cell phone, video streaming service such as Netflix, HBO, Disney+ and Hulu, and utility payments to your Experian credit report. What’s really great about this is that you can also choose the positive payment histories from these payments that you want to add.

Experian will gain access to up to 24 months of information from your accounts, which essentially means that you can add two years of positive payment history to contribute to your credit score, which is great.

However, it’s important to bear in mind you’ll require at least three months of payments within a six-month period in order for Experian Boost to work effectively.

Experian Boost Pros

- If you have a lack of credit history, Experian Boost can help you to improve your FICO score.

- You can increase your credit score by up to 13 points, but results may vary. This might not seem like a lot, but it can take you from an average to good, or good to great credit score.

- It’s free to use Experian Boost, and there are no membership requirements if you want to sign up to the service.

- Experian Boost puts you in greater control of your credit rating because you can choose to exclude payments that you don’t want added to your report. So, no negative data will be reported that could decrease your credit rating.

Experian Boost Cons

- Some lenders will be using a different credit scoring model that might not be compatible with Experian Boost. This means you might not always benefit from using it.

- You won’t get much of a benefit from using Experian Boost if you’ve been using credit cards for a long time and pay your bills on time as your credit history will already reflect payment history from these payments.

There are also other players in this space that are worth looking into. At the very least you will learn from each site you visit.

Who Is Experian Boost Best For?

If you need the extra boost to your credit score, such as because you don’t have a long history of credit behind your name, Experian Boost can be beneficial for you.

Similarly, if you’re always paying your utility and cell phone bills on time but you don’t have a loan account or credit card account, then you can make the most of them instead of letting your on-time payments for such services go to waste.

At least they can work towards helping you build your credit rating.

It also pays just to be educated on some of this stuff. A good way to look at this type of learning is to review like 5-10 different credit sites and you will start to see patterns.

What About UltraFICO?

UltraFICO is another way in which you can boost your FICO score. It allows you to use data from checking accounts, money market accounts, and savings accounts to improve your credit score. It’s a free service to use.

UltraFICO is a credit scoring model that was created by Finicity, FICO, and Experian. Its goal is to give greater credit access to many more consumers.

However, in order to get your UltraFICO score you have to apply for credit. If your application for a new loan or credit card gets denied, you can then use UltraFICO instead of your FICO score.

While UltraFICO shares some similarities with Experian Boost in that it’s a way for you to improve your FICO score in non-traditional ways, it only lets you provide your banking habits as payment history.

It also requires you to apply for credit before you can use the UltraFICO score service, whereas you don’t have to do this if you want to use Experian Boost.

Related Questions

Does anyone have an 850 credit score?

Approximately 1.6 percent of the population in the U.S. has a perfect 850 credit score.

What’s a good credit score to achieve?

You don’t have to have a perfect credit score. In fact, it’s said that a score of 760 is ideal because you can get the best interest rates for car loans at around 720 or higher and 760 for mortgages.

So, you should aim for 760 as a minimum score.

Conclusion

If you want to improve your credit score, you can do so quickly, such as by using a service such as Experian Boost.

What’s it all about and is it worth it?

After reading this article, you now have a better idea about it and its benefits so you can get the loans you need and achieve better interest rates. We’ve also looked at how Experian Boost has a bit of an edge over its competitor, UltraFICO.

Sources:

Is it Safe to Use Experian Boost?

Paul Martinez is the founder of BendingDestiny.com. He is an expert in the areas of finance, real estate, and eCommerce.

Join him on BendingDestiny.com to learn how to improve your financial life and excel in these areas. Before starting this blog, Paul built from scratch and managed two multi-million dollar companies. One in the real estate sector and one in the eCommerce sector.